Robert Kiyosaki’s bestseller challenges traditional views on money, contrasting two father figures: the author’s educated but financially struggling “poor dad” and his friend’s wealthy “rich dad.”

Overview of the Book and Its Impact

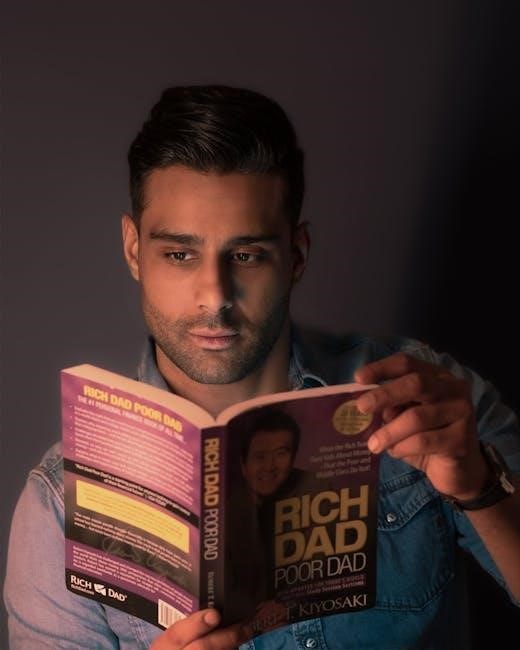

Rich Dad Poor Dad by Robert Kiyosaki is a groundbreaking personal finance book that has sold over 40 million copies worldwide, becoming a New York Times bestseller. First published in 1997, it challenges conventional wisdom about money, work, and wealth. The book narrates Kiyosaki’s upbringing with two father figures: his “poor dad,” a well-educated but financially struggling man, and his “rich dad,” a high school dropout who amassed significant wealth. Through their contrasting financial philosophies, Kiyosaki emphasizes financial literacy, asset accumulation, and entrepreneurship as keys to achieving financial independence. The book’s relatable storytelling and unconventional advice have made it a global phenomenon, inspiring millions to rethink their approach to money and wealth-building. Its impact extends beyond personal finance, influencing entrepreneurship and investment strategies worldwide.

Author Background: Robert Kiyosaki

Robert Toru Kiyosaki is an American entrepreneur, investor, and motivational speaker, best known for authoring Rich Dad Poor Dad. Born on April 8, 1947, in Hilo, Hawaii, Kiyosaki grew up in a middle-class family and struggled academically. After graduating from college, he served in the U.S. Marine Corps during the Vietnam War. Following his military service, Kiyosaki pursued various business ventures, including founding a company that produced the first nylon Velcro wallet, which brought him initial financial success. However, it was his writing career that catapulted him to fame. Drawing from his personal experiences with two father figures—one financially struggling and the other wealthy—Kiyosaki’s books have become synonymous with challenging traditional views on money and advocating for financial independence through entrepreneurship and smart investing.

The Concept of Two Dads: Rich Dad vs. Poor Dad

The cornerstone of Rich Dad Poor Dad lies in the contrasting financial philosophies of two father figures in Robert Kiyosaki’s life: his own “poor dad” and his best friend’s “rich dad.” His biological father, a well-educated but financially struggling man, believed in securing a stable job and adhering to traditional views of money. In contrast, his friend’s father, a wealthy entrepreneur, embraced risk-taking, entrepreneurship, and building assets. These opposing viewpoints shaped Kiyosaki’s understanding of money, emphasizing the importance of financial literacy, investing, and creating wealth-generating assets. The “rich dad” mentality encourages readers to think beyond conventional employment and strive for financial freedom, while the “poor dad” mindset highlights the limitations of relying solely on salary and education for economic security.

Key Themes and Lessons

Rich Dad Poor Dad emphasizes financial independence through entrepreneurship, investing, and building assets. It challenges traditional views on money, advocating for wealth-building strategies over salary reliance.

Financial Education and Literacy

Financial education is a cornerstone of Rich Dad Poor Dad, emphasizing the importance of understanding money, investing, and managing finances. Robert Kiyosaki highlights the stark contrast between his “poor dad,” who relied on a paycheck, and his “rich dad,” who built wealth through assets. The book advocates for shifting focus from saving money to increasing income streams. It teaches readers to differentiate between assets and liabilities, stressing that true wealth comes from owning assets that generate income. Kiyosaki also underscores the need for practical financial skills, such as budgeting, investing, and tax strategies, often overlooked in traditional education. By empowering individuals with financial literacy, the book encourages them to take control of their economic futures and pursue financial freedom.

The Importance of Assets vs. Liabilities

A key concept in Rich Dad Poor Dad is the distinction between assets and liabilities. Robert Kiyosaki defines assets as items that generate income, such as investments, real estate, or businesses. Liabilities, in contrast, are expenses that drain resources, like personal cars or credit card debt. The book emphasizes acquiring and multiplying assets to build long-term wealth, rather than accumulating liabilities. Kiyosaki critiques the common practice of prioritizing high-income jobs over asset-building, advocating instead for financial independence through asset ownership. This principle challenges readers to rethink their spending habits and focus on creating passive income streams, ultimately leading to financial freedom and security.

Entrepreneurship and Taking Risks

Entrepreneurship is a cornerstone of wealth-building in Rich Dad Poor Dad. Robert Kiyosaki advocates for taking calculated risks to create income-generating assets, emphasizing that financial freedom often requires stepping beyond traditional employment. He criticizes the mindset of seeking job security, instead encouraging readers to build businesses or invest in ventures that produce passive income. Kiyosaki believes that entrepreneurship fosters financial independence, enabling individuals to break free from the cycle of earning a paycheck and instead creating systems that generate wealth.

Kiyosaki also highlights the importance of learning from failure, viewing it as a stepping stone to success. By embracing risk and pursuing entrepreneurial ventures, individuals can achieve financial independence and accumulate lasting wealth.

Mindset and Financial Freedom

Robert Kiyosaki emphasizes that mindset is the foundation of achieving financial freedom. He contrasts the limiting beliefs of his “poor dad,” who viewed money as a source of security through a paycheck, with the empowering perspective of his “rich dad,” who saw money as a tool for wealth creation. Kiyosaki argues that adopting an entrepreneurial and investment-oriented mindset is crucial for building wealth. Financial freedom, he explains, is not just about earning more but about managing money effectively to generate passive income. By shifting focus from job security to asset accumulation, individuals can break free from financial slavery and live life on their own terms. This mindset transformation is central to Kiyosaki’s philosophy, enabling readers to pursue their passions without being bound by the need for a steady income.

Critical Analysis and Controversies

Despite its popularity, “Rich Dad Poor Dad” faces criticism for oversimplified financial advice and lack of actionable strategies. Some argue its concepts are impractical for real-world application.

Criticisms of the Book’s Advice

Some critics argue that Rich Dad Poor Dad oversimplifies complex financial concepts, offering advice that is often impractical for average readers. The book’s emphasis on entrepreneurship and real estate investment is criticized for being too generic, failing to provide detailed strategies. Critics also point out that Kiyosaki’s approach encourages risky financial decisions, such as taking on excessive debt, which can lead to financial ruin for those who follow it without caution. Additionally, the book’s dismissal of traditional employment and higher education is seen as unrealistic, as not everyone has the resources or inclination to pursue entrepreneurship. While the book inspires financial awareness, its lack of actionable, nuanced advice has drawn significant criticism.

Real-World Applications of the Concepts

Many readers have applied Rich Dad Poor Dad’s principles to achieve financial success. By focusing on acquiring assets that generate income, such as real estate or businesses, individuals have built wealth. The book’s emphasis on financial literacy has inspired people to take control of their money, often leading to improved budgeting and investment decisions. Entrepreneurs have credited the book with motivating them to start their own businesses, fostering a mindset shift from being employees to becoming employers. While results vary, the book’s core ideas have empowered many to pursue financial independence and rethink traditional approaches to money management, making it a practical guide for those seeking to improve their economic standing.

Legacy and Influence

Rich Dad Poor Dad has become a foundational resource for wealth-building strategies, inspiring millions to rethink money and pursue financial freedom, leaving a lasting impact on personal finance education.

Popularity and Sales Performance

Rich Dad Poor Dad has achieved unprecedented success, selling over 40 million copies worldwide and becoming a New York Times bestseller. Its enduring popularity stems from its relatable storytelling and practical financial advice, making it a global phenomenon. The book has been translated into numerous languages, reaching readers across diverse cultures. Its influence extends beyond personal finance, inspiring entrepreneurship and wealth-building strategies. The book’s success has solidified Robert Kiyosaki’s status as a leading voice in financial education, with its messages resonating with audiences for decades.

Impact on Personal Finance and Wealth Building

Rich Dad Poor Dad has revolutionized personal finance by shifting mindsets from earning a paycheck to building wealth through assets. It emphasizes financial literacy, entrepreneurship, and investing over traditional employment. The book’s principles have inspired millions to pursue passive income, challenging the status quo of money management. By advocating for asset acquisition and financial independence, it has empowered readers to take control of their financial futures. Its teachings remain influential, reshaping how people view money and wealth, and motivating them to adopt strategies for long-term financial success.